Reliable bookkeeping and technology for clearer financial insights.

It's 50/50 people and software - smart tools for instant insights, expert people for strategic guidance. Both working together on your business.

Trusted by 100+ growth-driven startups and small businesses

Reliable bookkeeping for clearer financial insights

It's 50/50 people and software—smart tools for instant insights, expert people for strategic guidance. Both working together on your business.

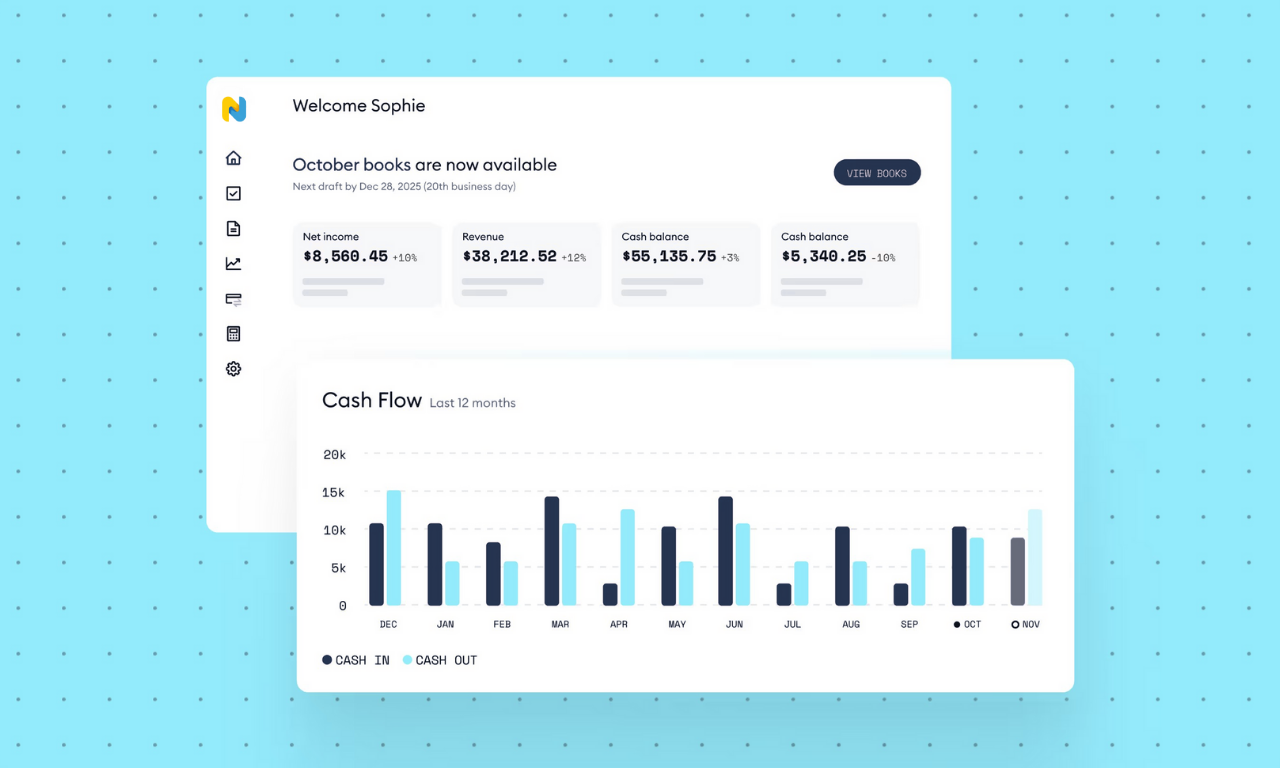

Model cash flow

scenarios

Know if you can afford new hires well before you make the offers.

Track company expenses in real time

Find the $2,000/month you didn't know you were wasting.

Know what’s going on, now, with Numinor AI

"Why are sales up but cash flow is down?"

"What happens if we hire two more people?"

"Which expenses are growing faster than revenue?"

Smart tools. Smarter people. Confident decisions.

Total Peace of mind

Put your books in expert hands

Bookkeeping for startups and small businesses, done right. We're not your average accounting firm — we're the largest startup and small business accounting provider in the Canada. We have unparalleled expertise helping hundreds of businesses like yours succeed.

How Our Bookkeeping Solutions Work

Personalized Onboarding

Your dedicated team learns your business and connects to your financial data sources, ensuring a tailored approach to your bookkeeping needs and setting the stage for accurate books.

Streamlined Communication

Communicate directly with your team through our user-friendly portal, where you can ask questions and provide feedback on any outstanding items needed to finalize your books every month.

Accurate Books

We deliver monthly P&L, Balance Sheet, and Statement of Cash Flow reports that offer insight into your company’s financial health and enable you to make informed decisions. Plus stay up to date with real time account data directly in the portal.

STREAMLINED INTEGRATIONS

Sync your favorite finance tools, seamlessly

We have deep expertise in the tools you use, and leverage integrations to ensure that your monthly bookkeeping process is effortless.

AND 100+ MORE INTEGRATIONS

Your all-in-one accounting partner

We have bookkeeping and accounting services to support your business at every stage.

Tax

Get your tax prep and bookkeeping handled seamlessly, together. We file your business income taxes, including GST/HST filings, and provincial and federal tax returns – so that you’re compliant with the CRA.

CFO Services

Need advanced finance support? We have your back. Get the expert CFO support for your business needs, from building budgets to fundraising preparation.

SR&ED Tax Credit

The SR&ED tax credit could save your business up to $2,000,000 a year. We handle the whole claiming process so you can skip the paperwork and get back to business.

From the Numinor blog

Resources for scaling your startup

See what Numinor can do for you

Get the peace of mind that comes from partnering with our experienced finance team.