Employee or Subcontractor? The CRA Checklist Every Trade Business Needs

The #1 audit trap for Canadian trades. A quick checklist to tell if your “helpers” are actually employees in the eyes of the CRA.

It’s a scenario that plays out in supply houses and coffee shops across Canada every morning. You’re a busy HVAC owner or General Contractor. You land a big renovation project that needs to be done yesterday. You don't want the hassle of hiring a full-time employee, setting up payroll, and paying WSIB premiums just for a three-week rush.

So, you call a guy you know. Let’s call him Steve. Steve has his own truck and says, "Just pay me an hourly rate and I’ll invoice you."

It sounds perfect. You cut Steve a cheque, he does the work, and everyone goes home happy.

Except, six months later, the CRA audits you. They decide that Steve wasn't actually a subcontractor, he was an employee. And suddenly, you owe thousands of dollars in back-dated CPP, EI, and penalties.

This is the "Employee vs. Independent Contractor" trap and the CRA is scrutinizing it closer than ever.

Why the CRA Cares So Much

To the average business owner, the difference might feel like semantics. But to the government, the difference is massive.

When you hire an employee, you act as a tax collector. You withhold income tax, Canada Pension Plan (CPP), and Employment Insurance (EI) premiums. You also contribute the employer portion of those premiums.

When you hire an independent contractor, no taxes are withheld. The contractor gets the full gross amount and is responsible for their own taxes.

The CRA prefers employees because compliance is higher. They know that a business with a payroll department is far more likely to remit taxes correctly than a loose network of guys trading cash and invoices. That is why, in any grey area, the CRA will almost always rule that a worker is an employee.

How the CRA Actually Decides Who is a Subcontractor

The most important thing to understand is that you cannot just decide someone is a subcontractor. You can write a contract that says "independent contractor" in bold red letters at the top, but if the working relationship looks like employment, the CRA will call it employment.

When a CRA officer reviews your files, they use a four-point test to determine the reality of the relationship.

1. Control: Who is driving the bus?

This is the biggest factor. "Control" refers to the ability to direct how and when the work is done.

Employee Relationship: You tell the worker to show up at 8:00 AM at 123 Main Street. You tell them exactly which pipes to install, which method to use, and you supervise them throughout the day. If they want to leave early, they have to ask you. You have the right to hire or fire them.

Subcontractor Relationship: You tell the worker, "I need a bathroom roughed in at 123 Main Street by Friday." The worker decides when to show up, how to do the job, and when to leave, as long as the result meets the standard.

If you are micromanaging their day-to-day activities, they are likely an employee.

2. Tools and Equipment: Who owns the drill?

In the trades, this is usually the easiest differentiator to spot.

Employee Relationship: You provide the van, the heavy machinery, the expensive ProPress tool, and the materials. The worker might show up with their own hand tools (hammer, tape measure), but you are supplying the "capital" required to do the job.

Subcontractor Relationship: The worker shows up in their own vehicle with their own tools. If a special tool is needed (like a concrete saw), they rent it themselves or they already own it.

The CRA looks at this because providing tools implies you are taking the financial risk of the capital investment, which is a hallmark of being an employer.

3. Financial Risk: Who pays for mistakes?

This is the factor that often catches business owners off guard.

Employee Relationship: If your worker installs a furnace incorrectly and it leaks, you (the business owner) have to pay to fix it. You pay the worker for their time regardless of whether the job was profitable or a disaster. The worker has no financial risk; they get paid their hourly wage no matter what.

Subcontractor Relationship: If a true subcontractor screws up an install, they have to go back and fix it on their own time and their own dime. They bear the financial risk of their own incompetence. If the job goes over budget, they might lose money.

4. Opportunity for Profit: Can they hustle?

Employee Relationship: An employee generally cannot make a "profit." They can earn a bonus or overtime, but they can't decide to work faster to increase their margin. They are paid for their time.

Subcontractor Relationship: A subcontractor can negotiate a flat rate for a job. If they are efficient and finish in two days instead of four, they have made a "profit" on their time. They are also free to accept work from other clients at the same time.

The "Intent" Factor (and why contracts matter)

While the 4-point test is the ultimate judge, the CRA does look at the "intent" of the parties. This is where having a written agreement helps.

If you genuinely intend for a worker to be a subcontractor, you should have a signed contract that explicitly states:

They are responsible for their own liability insurance (and you should have a copy of their WSIB clearance certificate).

They are free to accept other work.

They are responsible for correcting their own defective work.

If you don't have a contract, the CRA will infer the intent from your actions. If "Steve" has worked for you 40 hours a week for 5 years, has no other clients, and drives a truck with your logo on it, no amount of arguing about "intent" will save you.

The Cost of Getting It Wrong (The "PIER" Review)

So, what happens if the CRA decides you misclassified Steve?

They will initiate a Pensionable and Insurable Earnings Review (PIER). They will calculate the total amount of CPP and EI that should have been deducted from Steve’s pay for the entire period he worked for you.

Here is the kicker: You can't ask Steve for that money back.

You, the employer, are responsible for paying:

The employer’s share of CPP and EI.

The employee’s share of CPP and EI (because you failed to deduct it).

A 10% penalty on the total amount.

Interest on the overdue amount.

For a single worker earning $60,000 a year, this re-assessment can easily cost you $7,000 - $10,000 in immediate liabilities for just one year of mistakes.

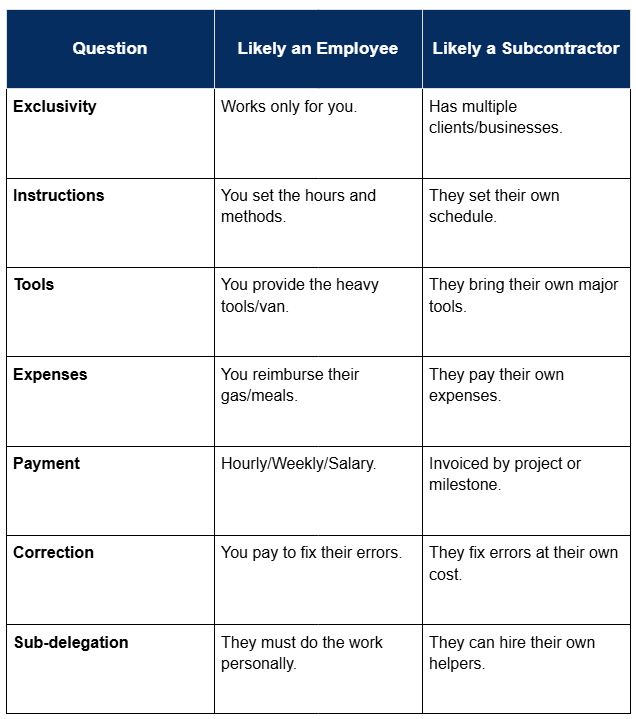

The Classification Checklist

Before you bring on help for your next project, run them through this checklist. If you check "Yes" to most of the Employee column, put them on payroll.

Final Thoughts: Payroll vs. Invoicing

There is a time and place for subcontractors. They are essential for specialized work (like hiring a gas fitter for a specific hookup) or for handling overflow during peak season.

However, if you are hiring someone to show up every day, drive your truck, and represent your brand, the safest path is payroll.

Yes, it requires more paperwork. Yes, you have to pay CPP and EI. But the cost of "doing it right" is a fraction of the cost of a CRA audit.

If you have a mix of employees and casual helpers and you aren't sure who falls into which bucket, Numinor can help. We can review your contracts, assess your risk, and help you set up a payroll system that is painless and compliant.

Let us take bookkeeping off your hands. Forever.

See how Numinor can help your finances with a personalized demo. Get your first month of books free when you sign up.