Tax Liability: What It Is and How to Calculate It

Your tax liability is simply how much you owe in taxes. If you’re a full-time employee, it’s usually a simple matter of your employer withholding tax at the source and you filing an annual return. If you’re self-employed or run your own business, it’s a bit more complicated.

This article was updated on Dec. 30, 2025, with the latest figures for the 2026 tax season.

What is tax liability?

Tax liability is the amount of money your business owes to the government. Once you file your return, either by yourself, with an accountant, or with a tax service like Numinor, the amount that you still owe is your tax liability. If you have paid more throughout the year than you owe, you will receive a tax refund.

How to calculate your tax liability

Gross income minus deductions equals taxable income.

Taxable income multiplied by your tax rate minus any tax credits you’re eligible for equals your total tax liability.

Because there are so many tax credits, deductions, and differences based on business structure, calculating your tax liability is complicated. If you’re going to do it yourself, here’s what you need to know.

What’s your business structure?

There are several ways to structure a business (corporation, partnership, sole proprietorship, etc.). But for the purposes of figuring out how much tax your small business owes, there are generally corporations and unincorporated businesses. If you have a small operation and you’ve never formally incorporated, the government classifies you as a sole proprietor.

Corporations are legal entities that pay corporate income tax on their profits.

Sole proprietorships and partnerships are "flow-through" entities. The business itself doesn’t pay income tax; instead, the profits flow through to the owners, who report the income on their personal tax returns and pay tax at their individual rates.

Calculate your estimated quarterly taxes (for free)

Use our quarterly tax calculator to estimate how much you owe.

How to figure out your tax rate if you’re incorporated

Corporations pay a flat tax rate, though this rate varies depending on whether you qualify for the Small Business Deduction (SBD).

For many Canadian-controlled private corporations (CCPCs) on the first $500,000 of business income, the net federal tax rate remains 9%. When combined with provincial rates (such as Ontario’s 3.2% small business rate), many small businesses pay a total effective rate of approximately 12.2%. Larger corporations pay a higher general rate, typically around 26.5% combined.

The concept of Integration

To avoid "double taxation," the Canadian tax system uses a system of dividends and tax credits. When a corporation pays out its after-tax profit as a dividend, the individual receiver gets a Dividend Tax Credit to recognize the tax the corporation already paid.

How to figure out your tax rate if you’re a sole proprietor

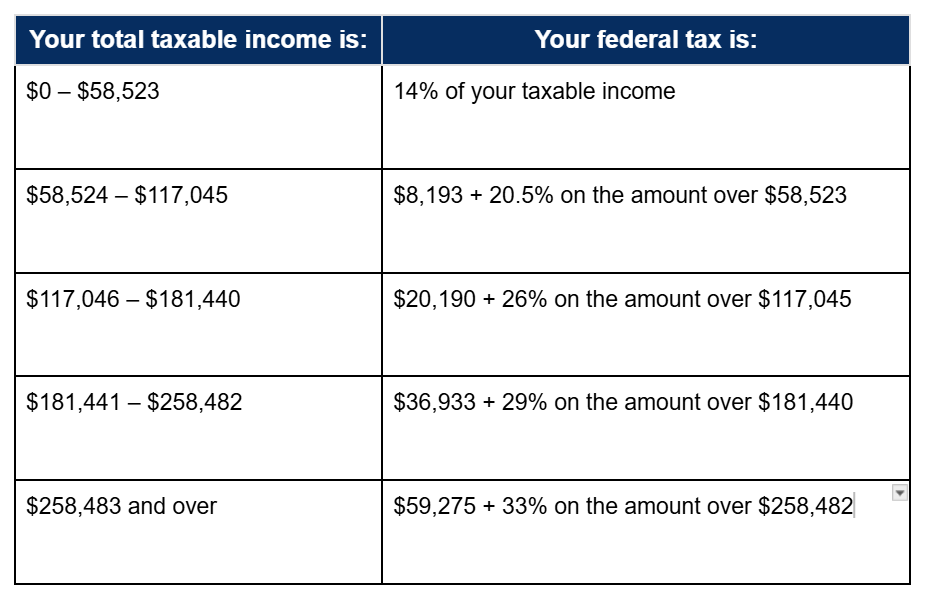

In 2026, the federal government has adjusted the tax brackets for inflation and reduced the lowest tax rate to 14%.

2026 Federal Tax Brackets:

Note: These are federal rates only. You must also add provincial or territorial income tax. For 2026, the Basic Personal Amount (the amount you can earn federally before paying any tax) is $16,452 for most taxpayers.

Reduce your tax liability with credits and deductions

You can reduce your tax bill using two methods:

Deductions: These reduce your total taxable income. For example, business expenses like home office costs or equipment are deducted from your gross revenue.

Credits: These are applied directly against the tax you owe. Common examples include the Basic Personal Amount and the Dividend Tax Credit.

Making instalment payments

If your net tax owing is more than $3,000 ($1,800 for residents of Quebec), you are generally required to pay tax instalments throughout the year. For 2026, these are due on March 15, June 15, September 15, and December 15.

Paying payroll taxes

If you have employees, your business must manage the following 2026 remittances:

Canada Pension Plan (CPP): The contribution rate remains 5.95% for the base portion. For 2026, the Year's Maximum Pensionable Earnings (YMPE) is $74,600. There is also a second tier (CPP2) of 4% on earnings between $74,600 and $85,000.

Employment Insurance (EI): The 2026 employee rate is $1.63 per $100 (up to a maximum insurable earning of $68,900). Employers pay 1.4 times the employee rate ($2.28 per $100).

Income Tax: You must withhold federal and provincial income tax from employee paycheques.

If you are self-employed, you are responsible for both the employer and employee portions of CPP (total 11.9%), which is calculated on your tax return.

The next step: paying your taxes

Determining how much money your small business owes in taxes is just the first step. Once you’ve figured this out, you’ll need to actually pay the taxes. If you’re stressed about saving enough money to cover your next tax bill, we have a few ideas that will help.

Let us take bookkeeping off your hands. Forever.

See how Numinor can help your finances with a personalized demo. Get your first month of books free when you sign up.