What is a Chart of Accounts? A How-To with Examples

This is a straightforward guide to the chart of accounts—what it is, how to use it, and why it’s so important for your company’s bookkeeping and CRA compliance.

Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account. But how do you know which account to record it in? The Chart of Accounts (COA) will tell you.

Below, we’ll go over what the chart of accounts is, what it looks like, and why it’s so important for your business.

What is the chart of accounts?

A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that makes up your business's general ledger. It provides you with a bird's-eye view of every area of your business that spends or makes money. The main account types include Revenue, Expenses, Assets, Liabilities, and Equity.

An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you'll get a dashboard that lists the different accounts you have—chequing, savings, a credit card—and the balances in each. It's a representation of your money and where it "lives."

The same is true of a business's chart of accounts. The difference is that most businesses will have many more types of accounts than your average individual, and so it will look more complex; however, the function and the concept are the same. Essentially, the chart of accounts should give anyone who is looking at it (like your accountant or the CRA) a clear idea of the nature of your business by listing all the accounts involved in your company’s day-to-day operations.

Chart of accounts sample

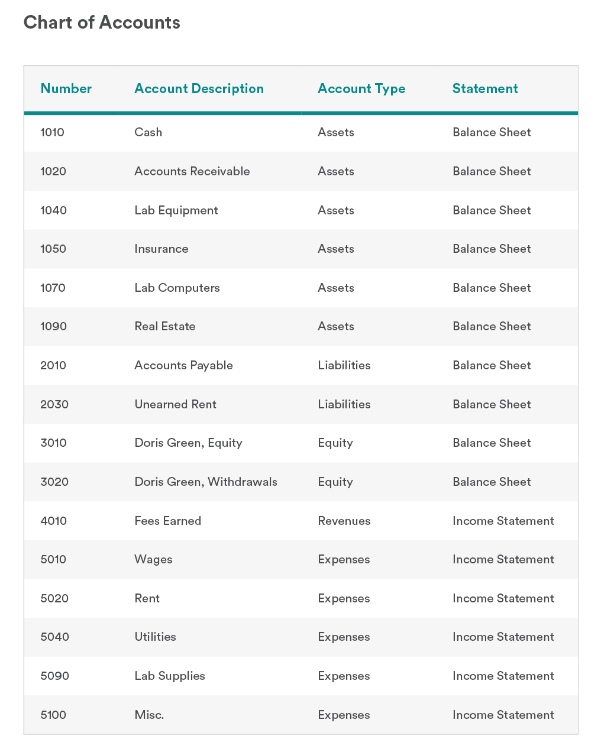

Here’s a sample COA for a fictional business: Doris Orthodontics.

As you can see on the right, there are different financial statements that each account corresponds to: the balance sheet and the income statement. Here’s what that means.

The balance sheet accounts

We call these the “balance sheet” accounts because we need them to create a balance sheet for your business. There are three kinds of balance sheet accounts:

Asset accounts: These record any resources your company owns that provide value. They can be physical assets like land, equipment, and cash, or intangible things like patents, trademarks, and software.

Canadian Startup Note: You will often see an account here for "GST/HST Recoverable" (or Receivable), which tracks the sales tax you have paid on expenses that you can claim back from the government.

Liability accounts: A record of all the debts your company owes. Liability accounts usually have the word “payable” in their name—accounts payable, corporate tax payable, etc.

Canadian Startup Note: Two critical accounts here are "GST/HST Payable" (sales tax you collected) and "Source Deductions Payable" (CPP, EI, and Income Tax withheld from employee payroll).

Equity accounts: These represent what’s left of the business after you subtract all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders. In Canada, this often includes "Common Shares" and "Retained Earnings."

The income statement accounts

We use the income statement accounts to generate the Income Statement (often called Profit & Loss).

Revenue accounts: Keep track of any income your business brings in from the sale of goods, services, or rent.

Expense accounts: All of the money and resources you spend in the process of generating revenues, i.e., utilities, salaries, and rent.

Canadian Startup Note: For tech companies, you might have specific accounts for "SR&ED Expenditures" to track costs eligible for tax credits.

The way that the balance sheet and income statement accounts interact with each other is complex, but one general rule to remember is this: revenues increase your company’s equity and asset accounts, while expenses decrease your assets and equity.

A note on reference numbers

You’ll notice that each account in the chart of accounts for Doris Orthodontics also has a five-digit reference number preceding it. The first digit in the account number refers to which of the five major account categories an individual account belongs to—“1” for asset accounts, “2” for liability accounts, “3” for equity accounts, etc.

Back when we did everything on paper, or if you're using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers.

Why is the chart of accounts important?

Without a chart of accounts, it's impossible to know where your business's money is. The chart of accounts is like a map of your business and its various financial parts.

A well-designed chart of accounts should separate out all the company’s most important accounts, making it easy to figure out which transactions get recorded where. It allows you to:

- Make better strategic decisions.

- Get an accurate snapshot of your company’s financial health.

- File your T2 Corporate Returns accurately.

- Present clean financials to investors or banks for funding.

How to adjust your chart of accounts

The rules for making tweaks to your chart of accounts are simple: feel free to add accounts at any time of the year, but wait until the end of the year (your fiscal year-end) to delete old accounts. If you delete an account in the middle of the year, it might mess up your historical data.

Let’s say that in the middle of the year, Doris realizes her orthodontics business is spending a lot more money on plaster because her new hire keeps getting the water-to-powder ratio wrong when mixing it.

Instead of recording it in the general “Lab Supplies” expenses account, Doris might decide to create a new account specifically for plaster to track that waste.

To do this, she would first add the new account—“Plaster”—to the chart of accounts.

She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account.

If she had already spent $2,000 on plaster up to that point, the adjusting entry would look like this:

Note: Moving expenses for plaster from the Lab Supplies expenses account to the Plaster expenses account.

A chart of accounts is a critical tool for tracking your business's funds, especially as your company grows.

Helpful resources for small businesses:

Let us take bookkeeping off your hands. Forever.

See how Numinor can help your finances with a personalized demo. Get your first month of books free when you sign up.