Corporate Tax Accountant in Kitchener

Our corporate tax preparation services in Kitchener provide you with end-to-end support for accurate T2 filings, from year-end review to submission. We follow CRA requirements closely, stay deadline-driven, and help incorporated businesses of all sizes stay compliant, organized, and confident in their reporting.

Corporate Tax Services for Businesses in Kitchener

We help businesses in Kitchener file correctly and on time, with a clear, complete T2 return supported by accurate year-end details. We review your information, confirm what the CRA expects for your situation, and prepare your submission with care.

As a local team, we understand Ontario tax requirements and the realities of running a corporation in Kitchener—whether you’re a professional corporation, a family-owned business, or managing multiple entities. Our corporate tax services in Kitchener are organized, deadline-driven, and easy to follow. We can support corporate tax filing in Kitchener remotely through secure document sharing, with in-person support available when needed.

Our Corporate Tax Preparation Services in Kitchener

As corporate tax accountants in Kitchener, we provide structured, end-to-end support to help corporations file accurately, stay compliant, and make informed decisions before and after year-end. Our approach is detail-driven and practical—focused on meeting CRA requirements while ensuring your filing reflects your business activity clearly.

T2 corporate tax return preparation for incorporated businesses, including schedules and supporting details

Corporate tax planning and optimization to support better timing decisions and smarter reporting strategies

CRA compliance and reporting to help reduce errors, missed disclosures, and avoidable follow-ups

Year-end financial review to confirm completeness, consistency, and readiness for filing

Tax deductions and credits identification based on your corporation’s activity and eligible expenses

CRA notices and audit support if you receive requests, reviews, or correspondence after filing

Why Choose Our Corporate Tax Accounting in Kitchener

You can expect clear timelines, straightforward explanations, and responsive communication throughout the process—so you always know what’s needed, what’s next, and when your filing will be completed.

As business tax accountants in Kitchener, we support incorporated businesses with a process that’s organized and deadline-driven. We review your year-end information thoroughly, flag common risk areas before filing, and ensure your T2 corporate tax return is prepared with the right schedules and supporting details. When tax planning opportunities exist, we take a proactive approach—helping you make informed decisions that align with your corporation’s goals while staying within CRA guidelines.

Industries we Serve Across Kitchener

We don’t believe corporate tax filing should be one-size-fits-all. Our corporate tax preparation for small businesses in Kitchener is tailored to the way your corporation actually operates, so your T2 filing is accurate, defensible, and stress-free.

Small Corporations & Growing Startups

Clean year-end review, accurate T2 filing, and support for changing finances as you scale.

Professional Service Firms

Clear, consistent filings with practical planning support and documentation-ready reporting.

Real Estate Companies

Careful handling of rental income, expense categorization, and CRA-ready records.

E-commerce Businesses

Help organizing multi-platform revenue, merchant reports, and the details behind your numbers.

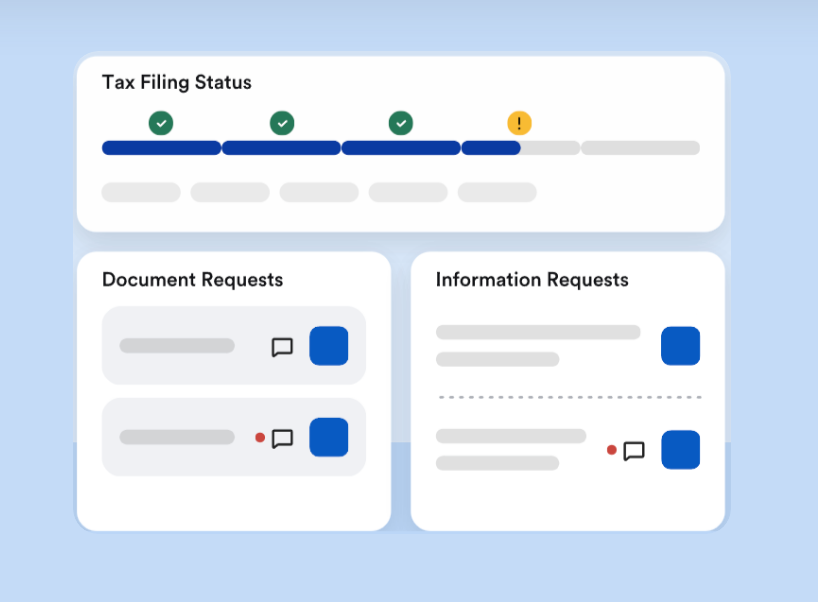

Our Corporate Tax Preparation Process

Our process for T2 corporate tax return Kitchener filings is structured, deadline-driven, and designed to keep expectations clear from start to finish.

Initial tax consultation

We confirm your corporation’s filing requirements, key dates, and any changes from the prior year that may affect your return.

We request the information needed for your T2, review your year-end financials, and flag missing items or CRA-sensitive areas early.

Document collection & review

Our team prepares your T2 corporate tax return, applies relevant deductions and credits, and ensures the required schedules and reporting are complete.

T2 preparation and optimization

Once approved, we file your return with the CRA and confirm submission details and timelines.

Filing with the CRA

If CRA notices, questions, or adjustments come up after filing, we support you with clear guidance and responses so you stay compliant and prepared.

Ongoing tax support

CRA Compliance & Corporate Tax Accuracy

For CRA corporate tax filing, accuracy matters—not only in the numbers, but in the schedules, disclosures, and documentation that support your return. Our team follows current CRA corporate tax regulations closely and manages the filing timeline to help you avoid late submissions, penalties, and preventable follow-ups.

We focus on clear, defensible reporting backed by proper records, so your T2 corporate tax return is prepared with audit readiness in mind. That includes reviewing year-end details for consistency, ensuring required schedules are complete, and helping you understand what should be retained on file.

Serving Businesses Across Kitchener & Nearby Areas

We support incorporated businesses throughout Kitchener and the surrounding region, with a process designed to be straightforward whether you prefer remote collaboration or occasional in-person touchpoints. Many of our clients are based in Downtown Kitchener, but we also work with corporations across Waterloo and Cambridge—from established service firms to growing companies with more complex reporting needs.

For businesses operating just outside the core, we regularly support clients in Baden and across Wilmot, where owners often want reliable tax filing support without unnecessary back-and-forth. No matter where you’re located in the region, our focus stays the same: organized information gathering, CRA-aware preparation, and a filing process that keeps deadlines and expectations clear.

-

Most corporations must file within 6 months of fiscal year-end. Any balance owing is usually due within 2 months (sometimes 3 months for eligible corporations).

-

Not required, but a corporate tax accountant in Kitchener can reduce errors, keep deadlines on track, and help ensure your filing is CRA-ready—especially as your business grows.

-

Typically: year-end financials (or trial balance), balance sheet details, shareholder info, fixed asset/depreciation schedule, and support for major expenses. Needs vary by corporation.

-

Through accurate reporting and proactive planning—claiming eligible deductions/credits, tracking loss carry-forwards properly, and making well-timed compensation or expense decisions.

-

Late filing can trigger CRA penalties, and late payments can accrue interest. Addressing deadlines early helps prevent avoidable costs.

-

Yes. We can review the notice, clarify what’s being requested, and help you respond with the right documentation and explanations.

-

Yes. We support incorporated businesses with multiple shareholders or more complex structures and ensure the T2 reporting aligns with the supporting records.

FAQs – Bookkeeping Services in Kitchener

Ready for Corporate Tax Filing You Can Trust?

Stop letting tax deadlines and unclear requirements create last-minute stress. If you want accurate, CRA-compliant support and a team that keeps your T2 on track, we’re here to help. Book a corporate tax consultation and get clear next steps for your filing.